Posted On

Posted On

Accounts Receivable Vs. Accounts Payable

Posted On

Posted On

Accounts receivable and accounts payable are two sides of business related to the revenue and expenses of the business. There must be a healthy equilibrium between expense and revenue. It helps the business maintain relationships with customers and suppliers. From the investor’s and lender’s point of view, the AR and AP provide information about the company’s financial position. It enables tracking the operating income and determining whether it can satisfy the short-term liabilities. Disbalance on any side will affect the business’s credibility; therefore, it is best to hire a Houston accountant.

Accounts receivable vs. accounts payable

- Accounts Receivable

Accounts receivable is the money owed by the accompany for services or goods sold on credit and recorded for a year. It will be reported under the title “current assets” in the balance sheet. When the company delivers good service on credit to the client, the AR team will issue an invoice to the customer, who will be recorded the same as AR.

- Accounts Payable (AP)

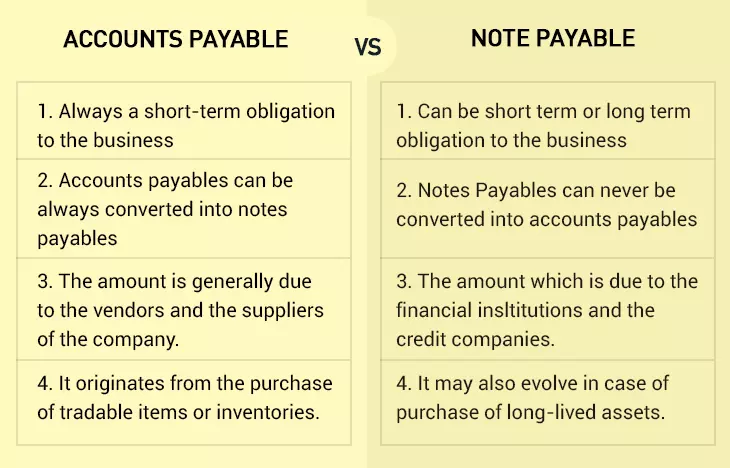

Accounts payable means the amount payable to the creditor and supplier of the company for services or goods purchased on credit and recorded for one accounting period.

But, long-term debts and payroll are recorded on the invoice receipt based on the payment terms. The total amount due to the third party for credit purchases is recorded as AP. It will be reported under the title “current liabilities” in the balance sheet.

Differences

- AR and AP are like the two sides of the coin. One side will show the amount due from customers, and another will show the amount payable to the creditors and suppliers.

- AR is known as the company’s current assets, whereas AP is known as the company’s current liabilities. They are continuously compared as a liquidity measurement to verify the availability of funds in meeting short-term expenses. The quick ratio and current ratio are used for comparison in liquidity comparison.

- Accounts payable are not available for offsetting the budgets for doubtful debt, whereas accounts receivable are available for such offsets.

Importance of AR and AP

Late payments are a significant concern in small businesses worldwide because it adversely impacts the cash flow and winds up with working capital bound up in the balance sheet. This extra working capital can be potential funds for growth investments, new product development, or boosting returns.

AR optimization helps to maintain a healthy and steady cash flow. This way, the business will have adequate cash to meet the expenses. Similarly, AP helps maintain healthy relations with the creditors and suppliers of the company.